| U.S. Bank Maintains High Credit Ratings |

|

|

Structured finance transactions require involvement from a number of service providers and counterparties including account and deposit banks, custodians, liquidity facility providers, and swap counterparties. These fundamental roles present a potential credit risk to the structure or noteholder. Examples of credit risk include account banks holding the income of the structure between payment periods and custodians holding the assets of the structure.

To minimise this risk, rating agencies require these providers

and counterparties to maintain a specific credit rating. Whether short term or long term, rating requirements are crucial for senior tranches to maintain high ratings.

Similar to other rating agencies, Moody’s requires its Aaa rated entities to maintain a minimum custodian rating of P-1 for short term. When an entity no longer satisfies this rating, the role in the transaction must be transferred to another appropriately rated entity. Generally, this transition must be done within a period of 30 days. The obligation to transfer varies across transactions, but may fall on the downgraded entity, issuing entity, or trustee.

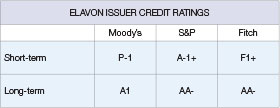

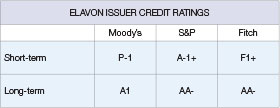

Recent downgrades have reduced the credit ratings of a significant number of structured finance market participants; however, U.S. Bank and its wholly-owned subsidiary, Elavon Financial Services, continues to maintain its credit rating above the minimum ratings required for account bank and custodian functions. Our current long term issuer credit ratings stand at A1/AA- by Moody’s and S&P respectively, and we continue to assist our existing and new clients by assuming roles from counterparties whose credit ratings have fallen below the required levels. Recent downgrades have reduced the credit ratings of a significant number of structured finance market participants; however, U.S. Bank and its wholly-owned subsidiary, Elavon Financial Services, continues to maintain its credit rating above the minimum ratings required for account bank and custodian functions. Our current long term issuer credit ratings stand at A1/AA- by Moody’s and S&P respectively, and we continue to assist our existing and new clients by assuming roles from counterparties whose credit ratings have fallen below the required levels.

Over recent months, U.S. Bank’s European Corporate Trust division has assumed roles on nearly 30 affected MBS/ABS and CLO transactions.

Our highly experienced Structured Finance team at U.S. Bank Global Corporate Trust Services is dedicated to supporting the unique business requirements of each client and every financial transaction. Our team works to understand your needs and can respond in a timely manner. Throughout the issuance process and ongoing administration of your transactions, our responsive specialists are committed to working under tight closing and operational deadlines to help ensure the success of our clients.

|

Recent downgrades have reduced the credit ratings of a significant number of structured finance market participants; however, U.S. Bank and its wholly-owned subsidiary, Elavon Financial Services, continues to maintain its credit rating above the minimum ratings required for account bank and custodian functions. Our current long term issuer credit ratings stand at A1/AA- by Moody’s and S&P respectively, and we continue to assist our existing and new clients by assuming roles from counterparties whose credit ratings have fallen below the required levels.

Recent downgrades have reduced the credit ratings of a significant number of structured finance market participants; however, U.S. Bank and its wholly-owned subsidiary, Elavon Financial Services, continues to maintain its credit rating above the minimum ratings required for account bank and custodian functions. Our current long term issuer credit ratings stand at A1/AA- by Moody’s and S&P respectively, and we continue to assist our existing and new clients by assuming roles from counterparties whose credit ratings have fallen below the required levels.