|

|

|

|

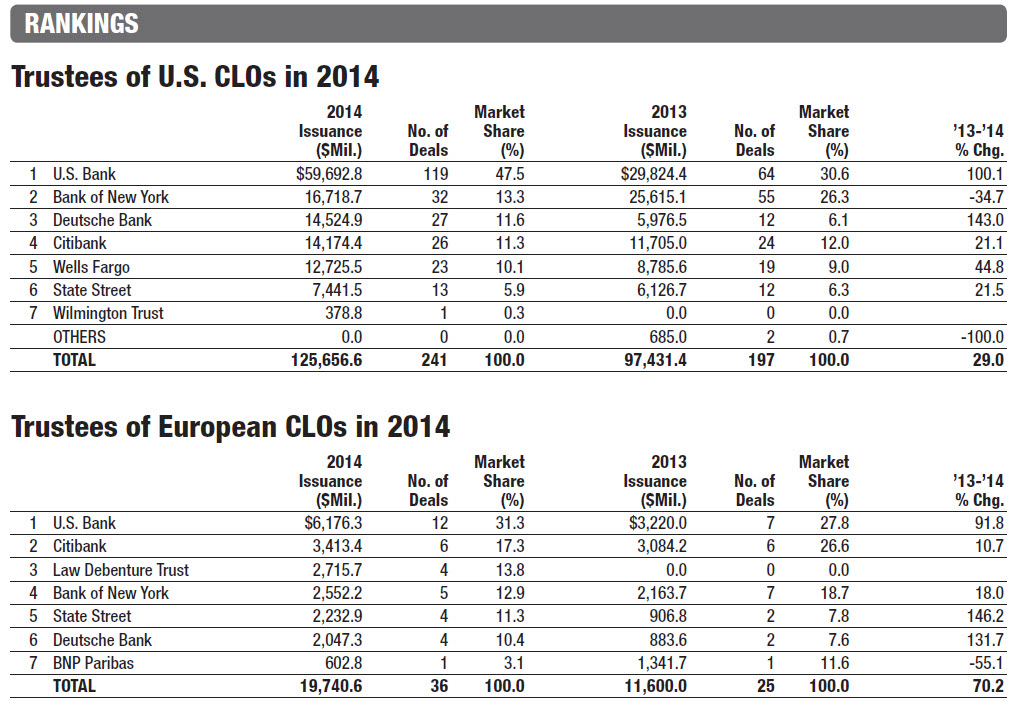

Global CLO Trustee Rankings Announced Global CLO Trustee Rankings Announced |

| For the second year running U.S. Bank Global Corporate Trust Services ranks top amongst Trustees in both the U.S. and European CLO Markets |

In total, GCTS was mandated on 131 CLO deals worldwide,

increasing its global market share from 32% in 2013 to 47% in

2014. More specifically in Europe, the bank continued to retain

existing clients and attract new ones, winning 12 deals during

2014. “This is a momentous achievement that we are all

hugely proud of” said Bryan Calder President of Corporate

Trust Services, “In a few short years, we have overtaken well

established competitors through hard work and investment

and are quickly extending our advantage. The future for our

European business is bright indeed!”

Source: AB Alerts

The European market has picked up considerably since the

first post crisis CLO issued by Cairn Capital in Feb 2013.

Since then volume has increased steadily from EUR 7.5bn in

2013 to EUR 14.2bn in 2014. Several reasons underpin the

recovery, particularly improved asset-liability arbitrage but also

a sufficient increase in the supply of leveraged loans available.

U.S. bank continues to partner with new managers coming

to market, offering full and comprehensive CLO servicing,

combining account bank, collateral administration, cash management,

investor reporting as well as the full range of agency and

trustee functions. Our focus on document execution and onboarding, together with a dedicated relationship

management team for the life of the transaction, enables us to

provide the highest levels of client service.

“Our focus on client service is our number one priority. It has

enabled us to build strong relationships with both established

collateral managers and those coming to market for the

first time” said Anatoly Sorin, Head of CLO Relationship

Management for Europe.

“Now the market has returned, we

have been able to really capitalise on the hard work we have

put in over the past years, particularly from repeat managers,

some of which are now on their third deal since the recovery.”

U.S. Bank has also made significant investment in technology,

unveiling the new web portal - “pivot” in 2014. Pivot delivers a

transparent and interactive portfolio management experience,

removing complexity from day-to-day CLO portfolio

administration.

“The cutting edge analytics embedded in pivot not only

streamline the reconciliation process but also can be used

to stress test loan portfolios and ultimately aid investment

decisions” said Emma Hamley, VP – Business Development.

“We have had considerable interest from the market in this

new platform and expect widespread take up during the year

ahead”.

If you would like more information on our CLO Trustee

and Agency services or would like to arrange a “pivot”

demonstration please contact Emma Hamley or Anatoly Sorin

for more information. |

| |

|

|

|