Economic and Financial Market Review and Outlook

Keith Hembre, CFA, Chief Economist

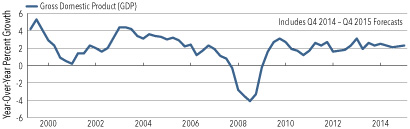

The economy has essentially performed as we expected in 2014. Gross domestic product (GDP) will likely approximate the 2% average of the last few years. Low U.S. inflation and interest rates persist. Many non-U.S. developed economies struggle to resume a pattern of growth, implementing a variety of stimulus measures. We anticipate more of the same in 2015, with modest returns and increased volatility. This may create opportunities for active management more broadly.

Expect the 2015 Economic Landscape to Look Familiar

In 2014, the economy has largely performed in line with our expectations. Full year GDP growth will likely settle at around 2%, roughly the average pace of the past several years. Inflation and long-term interest rates have remained low. We expect the economy will largely continue on this course in 2015.

Source: Bureau of Economic Analysis. Data from 3/31/00 to 12/31/15.

In our view, key 2015 themes for the economy and markets include:

- Trend economic growth will continue, with GDP advancing 2.0% to 2.5%.

- The labor market will likely reach the Federal Reserve's full employment threshold.

- The Federal Reserve (Fed) will likely begin cautiously raising policy rates around mid-2015 due to labor market improvements.

- Dollar strength and non-U.S. economic weakness will keep inflation subdued, but represent a new headwind for exports and profits originated outside the U.S.

- Sustained growth improvements in Europe, Japan and China remain elusive, resulting in further government stimulus.

- U.S. recession risks will remain low in 2015 but could build as we move into 2016.

- Long-term interest rates will likely remain below consensus expectations despite anticipated Fed policy moves.

- Market volatility measures will likely rise due to the end of quantitative easing and prospective policy rate increases.

How Will 2014 Economic Contributors Fare in 2015?

Consumer spending, the dominant component of GDP, should continue to grow in line with moderate personal income growth. The economic discontent voters expressed during the mid-term elections was likely due to the relatively slow pace of real income growth in recent years and an uneven distribution of income gains. The ongoing improvement in the labor market should provide a steady tailwind for income growth in the coming year, supporting the consumer spending outlook.

Lower interest rates could potentially aid the household sector, although the rate of decline so far this year has not increased credit demand in the mortgage market. Refinancing activity increased slightly following the last yield decline, but mortgage applications for home purchases recently reached their lowest level since the mid-1990s. It would likely take a substantial drop in yields to significantly improve mortgage demand, and we don't anticipate that happening. Despite the tepid demand response to lower mortgage rates, housing starts should continue to advance to 1.1 million units by the end of 2015 with large contributions from multi-family units.

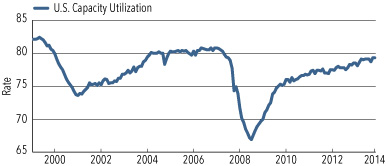

Business investment spending should also continue to show moderate strength based on continued sales growth. In addition, the capacity utilization rate has normalized from the depressed levels in the early stages of the recovery. The current rate of 79.3% is just below the previous peak utilization rate of 80.8% in December 2007. More fully utilized plants and equipment will likely require incrementally higher capital expenditures in the coming year to meet the demand of growing sales. But the outlook for growth in business spending is tempered by relatively modest final sales growth. Also, marginal oil production facilities may curtail spending if today's lower price levels continue. Regarding overall GDP growth, this spending decline would offset some benefits to the household sector due to lower oil prices.

Source: Federal Reserve. Data from 1/31/00 to 10/31/14.

Government spending should contribute slightly more to economic growth in 2015 as state and local government budget conditions continue to improve. Defense spending should also increase incrementally due to developments in the Middle East and elsewhere. Altogether, this should result in the economy continuing to grow in line with recent years.

Interest Rates Should Remain Below Expectations

The forces pushing U.S. inflation expectations lower are unlikely to reverse in the near term. Thus the inflation backdrop should remain consistent with longer-term interest rates remaining below consensus expectations in the coming year. The prospect of the Fed beginning to lift policy rates by mid-2015 should put upward pressure on longer-term yields, but the large spread between current policy rates and longer-term yields suggests moderate policy adjustments have already been incorporated into longer-term yields.

For example, the difference between the Fed's policy rate and the 10-year Treasury yield is currently about 2.35%, compared to a 30-year average spread of around 1.0%. Therefore, we might infer that longer-term yields are anticipating that policy rates will increase by 1.35% in the coming years. This has left longer-term U.S. Treasury yields much higher than nearly all other developed countries. In contrast, shorter-term yields are more vulnerable because they are much more sensitive to movements in policy rates. The difference between the 2-year Treasury yield and the policy rate is currently only about 0.5%, which implies the Fed's policy rate will not increase by more than 0.5% on average over the next two years. We should see these expectations rise if the economy follows our forecast.

The information provided represents the opinion of U.S. Bank and is not intended to be a forecast of future events or guarantee of future results. It is not intended to provide specific investment advice and should not be construed as an offering of securities or recommendation to invest. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Not a representation or solicitation or an offer to sell/buy any security. Investors should consult with their investment professional for advice concerning their particular situation. The factual information has been obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness.

Investment and Insurance products are:

| NOT A DEPOSIT | NOT FDIC-INSURED | MAY LOSE VALUE | NOT GUARANTEED BY THE BANK | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY |

The articles and information included in this newsletter are for your information and are not intended as legal, accounting or tax advice. U.S. Bank and its representatives do not provide legal, accounting and/or tax advice. Clients are encouraged to contact their legal, accounting and/or tax advisor regarding their particular situation. While the information is intended to be accurate, neither U.S. Bank Global Corporate Trust Services nor the publisher accepts responsibility for relying on the information provided.

Images may be from one or more of these sources: ©Thinkstock, ©2014 U.S. Bank Global Corporate Trust Services. Member FDIC.