New Auto ABS in Italy and Poland

FGA Capital, a joint venture between the Italian car maker Fiat and Credit Agricole, came to market this summer with the first public Italian Auto Loan Asset Backed Security (ABS) transaction in Italy since 2012. The new deal, A-BEST 9 was issued under the existing A-BEST programme.

U.S. Bank Global Corporate Trust Services is proud to act as Representative of Noteholders, Paying Agent, Account Bank and Cash Manager on the transaction. The 14 year EUR 500 mm funding is backed by a portfolio of over 50,000 loans extended to private customers resident in Italy; all loans are fully amortising implying the absence of residual value risk.

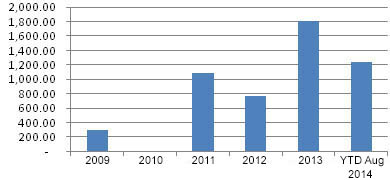

Both the EUR 437.5 mm Class A and the EUR 22.5 mm Class B were placed with institutional investors with the EUR 10 mm Class C and EUR 5 mm Class D Junior Notes being retained by FGA. The Italian ABS & MBS market is showing strong signs of recovery, “With further deals expected, 2014 is likely to outstrip 2013 in terms of issuance” said Laurence Griffiths, Head of Structured Finance Relationship Management for U.S. Bank Global Corporate Trust Services.

Not only is Italy seeing increased issuance, but Originators in peripheral countries such as Poland have tapped the Debt Capital Markets recently. Transactions such as SC Poland Auto 2014-1 Ltd originated by Santander Consumer Bank, wholly denominated in Polish Zloty, successfully closed in June and may pave the way for more Polish ABS deals to come.

The 11 year PLN 1.4 bn (EUR 326 mm) is backed by both Auto Loans (67% of the current principal balance) and Hire and Purchase Loans (33% of the current principal balance), which are mostly amortising, leaving a small exposure to residual value risk.

The transaction benefits from a liquidity mechanism, initially 2.0% of the class A and B notes, which can cover at least three months of note interest and senior expenses if needed.

U.S. Bank Global Corporate Trust Services is proud to act as Pledgee, Note and Security Trustee, Transaction Account Bank, Custodian, Principal Paying Agent, Calculation Agent, Cash Administrator and Common Services Provider for the transaction.

“We are excited to see the momentum across the consumer finance ABS market. We are working closely with many of the key arrangers and both mature and debut originators to provide the quality trust and agency support they need”, said Emma Hamley, Vice President, Business Development with U.S. Bank Global Corporate Trust Services.

The relationship management team at U.S. Bank Global Corporate Trust Services has a wealth of experience working on Auto ABS deals including E-Carat 2 Plc and E-Carat 3 Plc originated by GMAC as well as a number of Driver and two VCL deals originated by Volkswagen Bank and more recently Bavarian Sky Compartment 2 originated by BMW Bank.

For more information on recent transactions we have worked on, or further details on how we can assist in a variety of structured finance transactions, please contact U.S. Bank Global Corporate Trust Services today or visit us online at: usbank.com/corporatetrust.

Vice President, Business Development