| Nearly seventeen months after the introduction of the Funding for

Lending Scheme (FLS) by the UK Government, the program allowing

banks and building societies to borrow from the Bank of England

is slow to have an impact and market results have been mixed. |

| FLS has been a catalyst for record low mortgage rates directly

impacting individual homeowners, while also providing opportunity

for small and medium sized UK businesses. FLS has also had an

effect on the issuance levels of RMBS and UK covered bonds.

Although the link is difficult to accurately pinpoint, the Bank of

England has expressly mentioned the FLS when explaining the

significant drop in issuance levels in these markets. |

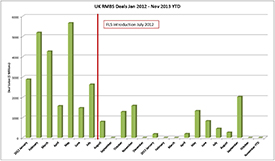

| Chart 1.0 below highlights the significant fall in issuance

since January 2012. |

|

|

| Wider European analysis suggests further amendments to the draft

of new regulation is expected on new CRDIV proposals, EMIR, the

Solvency II Directive and the proposed financial transaction tax.

Not all will have a negative impact on new issuance levels. Indeed

many should be positive, but the uncertainty surrounding the

final forms will certainly be a challenge for the market into 2014. |

| U.S. Bank Global Corporate Trust services continues to support

the RMBS and covered bond market and is providing the full range of trustee and

agency services on several deals that closed in 2013 including

Virgil Mortgage No.1, ALBA 2013-1 and Rochester Financing

No.1. “We continue to monitor the RMBS market and the impact of the FLS closely;

we expect a modest pick up next year due to continued portfolio sales and further

securitisation by banks in search of capital relief” said Emma Hamley, VP European

Business Development. |

| Interested in learning more about U.S. Bank Global Corporate Trust

Services? Visit us online at usbank.com/coporatetrust. |

|