Financial Solutions Frequently Asked Questions (FAQs)

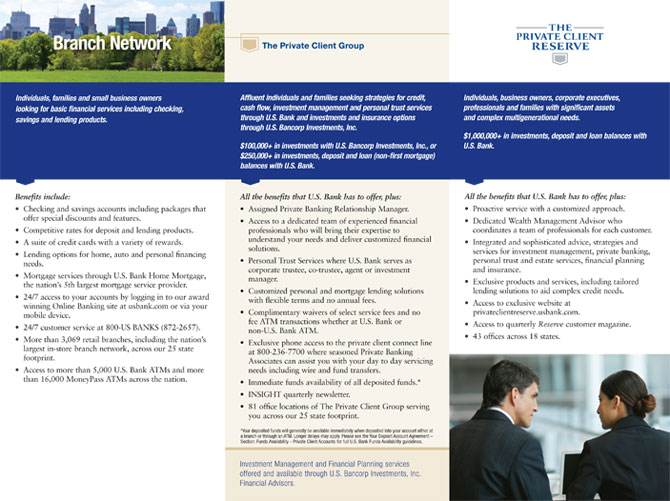

I'm happy with the financial products and services that I currently have. How can I continue to receive these services?The Private Client Group and The Private Client Reserve have minimum balance requirements.

If you feel that you should continue to be served in The Private Client Group or The Private Client Reserve, and have qualifying assets that you are able to bring to U.S. Bank, please call 800-722-9811. A Private Banking Associate will be happy to discuss your unique situation.

What changes will I experience as a result of being serviced by a U.S. Bank Branch?You will always have prompt, safe and secure access to your accounts via the branch, phone or online banking.

The following changes will be effective on September 1, 2012:

- Your personal deposit accounts will be subject to U.S. Bank's Funds Availability Policy which can be found beginning on page 14 of Your Deposit Account Agreement; section Funds Availability: Your Ability to Withdraw Funds - All Accounts. View the most current Your Deposit Account Agreement.

- Depending on your account types and usage, you may notice some applicable fees that are currently being waived. However, many of these fees may not be applicable or may continue to be waived as several of these services, noted with an asterisk (*) below, remain complimentary with a U.S. Bank Platinum Package.

| Annual Safe Deposit Box Rental Fee*1 |

Variable |

| Cashiers Check* |

$7.00 |

| Incoming Wire - Domestic |

$20.00 |

| Incoming Wire - International |

$25.00 |

| IRA Annual Fee Plan Balance Below $25,000 / Education IRA Plan Balances Below $5,000* |

$30.00 |

Non-U.S. Bank ATM Transactions*2

(includes withdrawals, balance inquiries, denied transactions, funds transfers and deposits)

|

$2.50 |

| Overdraft Protection Transfer Fee*3 |

$10.00 |

| Overdraft Protection Transfer Fee with Gold Package3 |

$5.00 |

| Statement with Check Images |

$2.00 |

| Traveler's Cheques (single signer)*4 |

2% of purchase |

Will my account numbers change as a result of being serviced by a U.S. Bank Branch?No. Your account numbers will not change as part of being serviced by a branch. You can continue to use the same checks, check & credit cards and Personal Identification Number(s) PINs.

I have scheduled recurring payments for some or all of my accounts; will they be disrupted by this change?No, there will be no changes to scheduled automatic and recurring payments.

Will I still be able to access my accounts online?Yes, your Online Banking, Bill Pay and Online Statements are still accessible.

Will the rates on my loans increase?No, there are no changes to the previously agreed upon rates or terms for your loans.

I currently utilize my private banker or the private client connect line for wire transfers. Can I continue to do so?You can continue to utilize the private client connect line for servicing requests, including wire transfers, through

December 31, 2012. After that time you will need to call U.S. Bank customer service at 800-US BANKS (872-2657), utilize Online Banking at

usbank.com or visit your

local branch depending on the service requested. Wire request will need to be initiated in person at a branch after December 31, 2012.

1 Fees may apply and vary by location and size of Safe Deposit Box. A 50% annual discount remains available with a Platinum Package, Premium Checking and for customers with a Senior customer indicator.

2 An additional surcharge fee will be applied by the ATM owner, unless they are participating in the MoneyPass® network.

3 For each day an Overdraft Protection transfer occurs, a fee will be charged to the checking account that received the transfer.

4 No fee single-signer traveler's cheques for Platinum Checking, Premier Checking and accounts with a Senior customer indicator.

U.S. Bank and its representatives do not provide tax or legal advice. Customers should contact their tax and/or legal professional regarding their particular situation.

| NOT FDIC-INSURED |

MAY LOSE VALUE |

NOT GUARANTEED BY THE BANK |

| NOT A DEPOSIT |

NOT INSURED BY ANY GOVERNMENT AGENCY |

For U.S. Bank:

Deposit and Mortgage products offered by U.S. Bank National Association. Credit Products are subject to normal credit approval. Member FDIC.

Deposit and Mortgage products offered by U.S. Bank National Association. Credit Products are subject to normal credit approval. Member FDIC.

U.S. Bank is not responsible for and does not guarantee the products, services or performance of its affiliates.

Deposit products and lending products offered by U. S. Bank National Association. Member FDIC. Credit cards are offered by U.S. Bank National Association N.D. Credit products are subject to normal credit approval.

Deposit products and lending products offered by U. S. Bank National Association. Member FDIC. Credit cards are offered by U.S. Bank National Association N.D. Credit products are subject to normal credit approval.