Medicare made simple. We are HealthSpire, a whole new way to comparing Medicare options over the phone. Our licensed insurance agents will take the time to assist you with reducing out-of-pocket costs. At HealthSpire, we have access to multiple insurance carriers, and will ask you a few preliminary questions to help you find Medicare options to discuss. We value your time. When you work with HealthSpire, your best interests are our top priority.

A Medicare Advantage plan, known as Part C or MA, is an alternative to Original Medicare (Part A and Part B). They cover all the services that Original Medicare (Part A + B) cover. Plus, they may offer the following extra services:

We proudly offer Aetna's Advantage Plan. Aetna serves an estimated 46.5 million people and 91 percent of their Medicare members are enrolled in plans rated 4.0 stars or higher.*

*(https://www.aetnamedicare.com/en/compare-plans-enroll/star-ratings.html)

underwritten by American Continental Insurance Company, an Aetna Company

A Medicare Supplement Insurance policy can help reduce out-of- pocket expenses. These plans help pay some costs that Original Medicare doesn’t cover. For example, copayments, coinsurance and deductibles.

These plans work alongside your Original Medicare coverage and have no restrictive networks. You can visit the physicians of your choice that accept Medicare patients. And you have freedom when choosing a health care provider, including specialists and specialty hospitals.

Some of the advantages of a Medicare Supplement Insurance (Medigap) plan include:

Medicare Supplement

Sample Plan F Benefits

Medicare Prescription Drug Plans, also called Medicare Part D Plans, help subsidize the costs of your prescription drugs.

Some of our prescription drug plans may include:

In addition to our comprehensive Medicare Advantage plans, Medicare Supplement insurance and Prescription drug plans, we also offer the following additional coverages.

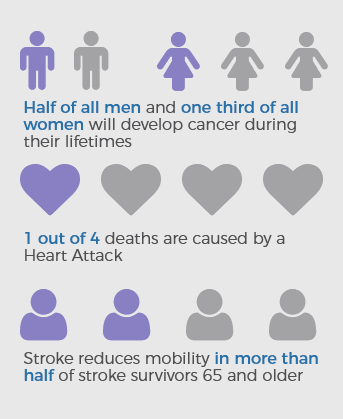

Cancer is the second most common cause of death - 1 out of every 4 deaths. About 87 percent of all cancers are diagnosed in persons 50 or older.

Heart attack is the number one cause of death for both men and women in the United States. More than 920,000 Americans will have a heart attack this year; half will occur with no warning signs.

Stroke is the third leading cause of death in women, the fifth leading in men, and among the top 10 in children.

With Aetna’s Cancer Heart Attack or Stroke insurance plan, you receive:

American Cancer Society, Cancer Facts & Figures 2017, www.cancer.org

Indemnity means "protection or security against damage or loss." Hospital Indemnity insurance can help offset costs that are not covered by your other insurance plans.

These costs can include deductibles, co-pays and unexpected or additional expenses. Benefits are paid directly to you, or a medical provider that you designate, and are paid in addition to any other health care coverage.

Some of the advantages of Aetna’s Hospital Indemnity plans are:

Our portfolio of affordable plans for individuals and families offer no waiting periods for some services after the deductible is met. And low or no office co-pays if you visit an in-network provider.

Whether you need simple cleanings, or crowns and root canals, eyeglasses and hearing aids we can find the level of coverage that makes sense for you starting as low as $34 month.

With Aetna’s Dental, Hearing & Vision plans, you’ll get:

Cancer is the second most common cause of death - 1 out of every 4 deaths. About 87 % of all

cancers are diagnosed in persons 50 or older.*

*American Cancer Society, Cancer Facts & Figures 2017, (www.cancer.org)

Heart Attack is the number one cause of death for both men and women in the United States.

More than 920,000 Americans will have a heart attack this year; half will occur with no

warning signs.*

*The Heart Foundation, Heart Disease Facts 2015. (www.theheartfoundation.org)

Stroke is the third leading cause of death in women, the fifth leading in men, and among the

top 10 in children. Stroke reduces mobility in more than half of stroke survivors 65 and older.*

*National Stroke Association, 2017 Facts, (www.stroke.org)

How would you and your family pay bills if diagnosed with these illnesses?

Indemnity means "protection or security against damage or loss."

Hospital Indemnity insurance can offset costs that are not covered by your other insurance plans. These costs can include deductibles, co-pays and unexpected or additional expenses. Benefits are paid directly to you, or a medical provider that you designate, and are paid in addition to any other health care coverage.

Our portfolio of affordable plans for individuals and families offer no waiting periods for some services. And low or no office co-pays.

Whether you need simple cleanings, or crowns and root canals, we can find the level of coverage that makes sense for you.

Understanding your Medicare options and selecting the plan that's right for you is a priority. Our team of Insurance Agents understand this process. They’re committed to informing you, simplifying the process and helping take some of the guesswork out of deciding.

Our broad selection of plans empowers our agents to:

We also understand that your healthcare insurance needs don't end at enrollment. That's why we're

here for you before and after enrollment. We want to ensure your questions are answered. Your health and personal goals are what drive us. When you work with HealthSpire, your best interests are our priority.

At HealthSpire we're dedicated to simplifying Medicare and helping you feel good about your coverage selection. Below are some of the most common question our licensed insurance agents here every day. If you have other questions, or just want to learn more about your Medicare options, don't hesitate to give us a call (888) 828-1940, TTY:711